Public Hearing for 30-Year Tax Break for New Bellaire Apartments

A public hearing will be held at 9:00 am on Thursday, December 7th in the Antrim County Board of Commissioner’s meeting room.

At this hearing, the public will have the opportunity to express opinions on a proposed 30-year tax break requested by Grand Rapids developers who want to build 138 apartment suites. If this plan is approved, these apartments will be built on a 19-acre parcel located at 6612 Bellaire Highway, on the site of the former gravel pit.

The Commissioners plan to vote on this tax break after the December 7th public hearing. The development plan and 30-year tax break have already been approved by the Village of Bellaire, Forest Home Township, and most recently at a meeting of the Antrim County Brownfield Redevelopment Authority.

At the most recent Brownfield Authority and County meetings, residents expressed concerns, mainly over the budget implications of such a project. There were also concerns about how the village’s character would change. Additionally, issues were brought up about the developer’s past history.

What are Details of the Project?

The 1983 Company will construct 50 townhomes for rent, which will include a total of 138 suites. Each townhome will have one-, two-, or three-bedroom suites, each with a full bath. Four one-bedroom homes will be designed for people with physical disabilities. If approved, modular construction will allow the townhomes to be constructed offsite during the winter months and shipped to Bellaire in the spring, with occupancy planned for late spring/early summer 2024.

Bellaire Lofts will be targeted towards individuals and families earning up to 120% of Antrim’s Area Median Income of $60,378. Rents will range from $825 for a one-bedroom suite to $2,400 for a three-bedroom townhome.

While the monthly rents are comparable to other local rents, the developers say that the cost of new construction will not permit rents at these rates without a housing construction subsidy. â€Without incentives, the project will not be constructed,†they stated. “Rents would need to average about $400 more per person to cover construction debt, operations, and maintenance. This puts rent costs well above what many area working people could afford to pay.â€

In addition to the 30-year tax break, the developers are also receiving a grant from the Michigan Department Housing Authority for environmental assessment, site preparation, and brownfield planning.

How Will the Tax Break Work?

Right now, the parcel in question only generates property taxes on the undeveloped portion. When the property is improved, property taxes would normally increase to reflect the new value.

Instead, the developers are asking for the property taxes to remain at the current amount paid for the undeveloped land. This would mean that $7.8 million in property taxes would be forgiven over the next 30 years. “There will be no cost to local government, since they aren’t collecting taxes now on the improved portion,†claimed Susan Wenzlick, consultant for the developer.

However, several residents pointed out that the increase in population will generate more activity for the government units, who are already strapped. In fact, the voters in Bellaire recently turned down a millage for the Village Police Department.

“The $68,258 that the developer will pay back to the township, village and county is not nearly enough to cover the services these people will use,†one resident countered.

Citizens pointed out that since there will be more than one person in many of the suites, this project could increase Bellaire’s population by as much as 30%. The new residents will wear down our roads. They will use the ambulance, police and fire departments, and much more.

“Who will end up paying for this increased use of government services?†a resident asked the board. “Since the developer won’t pay taxes on the improved property, that will leave it up to the rest of the citizens to pick up the slack.â€

The fairness of forgiving taxes was also discussed. There are landlords in the area such as Jason Green in Mancelona, who have fixed up dozens of old buildings to create rental housing for the area.

“People like Jason have lived here long term, and have greatly improved many buildings in the area,†claimed one resident. “These other landlords all pay very high non-homestead taxes on all of their rentals. How fair is it that a Grand Rapids developer pays no taxes, while competing with local landlords like Jason?â€

Most importantly, the developer’s questionable history was brought to the attention of the Brownfield Authority. There have been articles about a recent bankruptcy, and many lawsuits and complaints about past business practices.

“At least nine other lawsuits filed against Coppess and affiliated entities reinforce the same theme: Individuals made investments, were kept in the dark about where their money actually went, and were not paid back in the end,†according to one newspaper article written in 2020. “Several of the lawsuits allege Coppess was deceptive; others accuse him of falsifying documents to swindle potential investors into putting money into projects that never came to fruition.â€

Coppess told members of the Brownfield Authority that despite what was said in the newspaper, he ended up not filing bankruptcy, and said that he has made good on all his debts.

Is there a Housing Need in Antrim County?

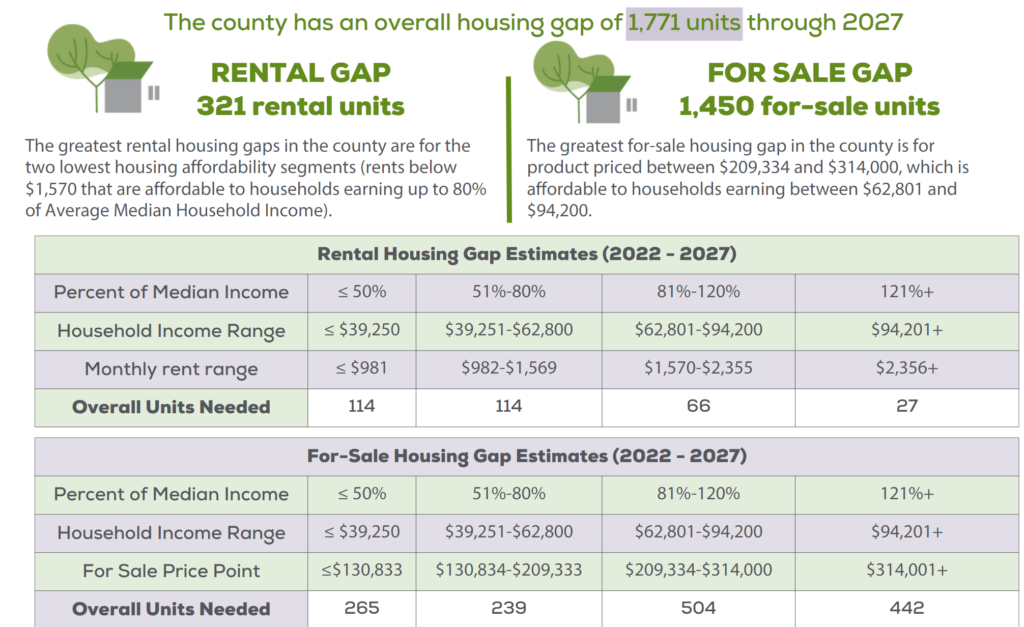

A 2023 study by Housing North estimates that “Antrim County currently has a need of over 300 more rental units.†The long-term rental vacancy rate for rentals in Antrim County is currently 0%.

Ironically, Antrim County also has the highest percentage of vacant housing units in Housing North’s 10-county region. 42.8% of housing units in Antrim County are vacant, representing seasonal occupancy, short-term rentals, and abandoned housing units.

This study also showed that more than 36% of renters are housing cost burdened, which means that their rent exceeds 30% of their income. More than 14% of renters are severely cost burdened and pay more than 50% of their income for housing.

Housing remains a challenge across the state. In September, the Michigan State Housing Development Authority board approved a brownfield incentives program to create and preserve rental and homeownership projects statewide.

Housing remains a challenge across the state. In September, the Michigan State Housing Development Authority board approved a brownfield incentives program to create and preserve rental and homeownership projects statewide.

If you can’t attend the meeting, you can email the Commissioners. Here is a list of their email addresses.Â

For more information, see the developer’s plan.

There is also a presentation you can watch at 1:54 during the October 5th Board of Commissioner meeting.

Better yet, eliminate property taxes for EVERYONE. That would make everyone’s housing far more affordable.

It is ridiculous to give these people a tax break on the backs of everyone else. He has a terrible history. He is not going to save the town.

Really? 30 freakin years? You old farts have no right making decisions that will outlive you.

By “old farts” I assume you’re talking about the Antrim County Board of Commissioner’s. They might well be “old farts” but they are elected by everyone that votes! Including all the “young farts,” or at least the ones that vote.

As for the question at hand, RE: tax break for this new housing. I say “no thanks,” based on the unfairness to local builders, their poor reputation, and the fact that it’s just too much of a break for too many years. $7.8 million in lost tax revenue over the next 30 years is a lot of change. Also I question why we want to “grow Bellaire?” The charm and beauty of Bellaire is that it’s a small piece of Americana, when that’s gone what is it going to be?

Coppess is not your town’s Savior. Have officials bothered to talk to anyone who has been involved in Grand Rapids? He definitely has not rebuilt the trust that he lost. That’s why he left town. His dishonesty and greed ruined many people.

No one has taken the time to research anything. They are all too busy celebrating the second coming.

We do need housing. But how are other landlords able to make it work without forgiving taxes? We have lots of vacant homes everywhere. Let’s fix up those.

This housing will end up going to people who have good jobs in other towns. Just like the rentals in Mancelona do.

Also, what happens when someone gets a raise and now earns too much to live there? Will this housing be a deterrent to achievement?

This plan is not family friendly. It is geared towards single people. Why would anyone want to rent a 2 bedroom. It usually isn’t twice as much as a one bedroom. How many single people are looking to live in Bellaire? It isn’t even an easy commute to any of the bigger towns.

Tax increment financing (TIF) is a powerful funding tool that can help cover the additional costs associated with redeveloping a brownfield property. When a brownfield redevelopment generates new tax revenue, those new taxes can be captured by a local brownfield redevelopment authority (BRA) and given back to the developer to reimburse them for the eligible costs associated with redeveloping the property.

Brownfield TIF is authorized under the Brownfield Redevelopment Financing Act, PA 381 of 1996 (Act 381). It can help:

Revitalize abandoned properties and return them to tax rolls

Attract developers to brownfields, creating jobs and investment, and increasing nearby property values

Provide a source of repayment for EGLE Brownfield Redevelopment Loans

Reduce sprawl by reusing properties with existing infrastructure

The premise of brownfield TIF is simple:

When a vacant, blighted, contaminated, or otherwise challenged property is redeveloped it becomes more valuable.

The increase in value results in an increase in property taxes paid to the municipality, school district or other taxing authorities for that property.

The additional tax paid due to the increased property value is referred to as the increment.

The increment is “captured†by the taxing authority and used to reimburse the developer for the cost of addressing brownfield conditions on the property during construction.

The brownfield activities eligible for reimbursement are defined in the Brownfield Redevelopment Financing Act (Act 381). They require local and sometimes state approval.

Once the developer has been reimbursed for the approved eligible brownfield activities on a project the taxing authority begins retaining all taxes collected for the property, fully realizing the increase in tax revenue from the development.

These “private public partnerships” used to be Republican pet projects. Now corporate welfare has also become Michigan Democrats’ top priority.

https://www.mackinac.org/blog/2023/corporate-welfare-is-michigan-democrats-top-priority

Here’s the bottom-line FACT that no one can deny: When corporations get special handouts from the government, it costs the rest of us. We have to pay more in taxes to make up for these hidden tax breaks, subsidies, and loopholes. In turn, there’s less money for good schools and roads, police, fire, and ambulance, and everything else we need.

So the next time you hear conservatives railing against welfare handouts for the poor, remind them that we should really be cutting corporate welfare—unnecessary and unwarranted aid for dependent corporations.

But there is no blight on this property. The property requires no extra work or care. Everything you cut and pasted refers to the original Brownfield program as it was designed to clean up properties.

I have no idea why they call this housing law a brownforld oportunity. It is very confusing and misleading to people. Just like you posting this is confusing and misleading. Seems you are trying to get us to believe this guy is cleaning up pollution. Not so.

These people can use all the fancy terms they want but we can see through it. This is basically a payoff to an out of town developer who says he can’t make a profit without leeching off the townspeople. This benefits no one but him.

So, will all these units comply with our Governor’s 2040 Clean Energy Plan???? Or, will we foot the bill twice to get them in compliance later? Won’t that be great? This seems like a bad deal for taxpayers in Antrim.

My wife and I just finished up 6 duplexes (12 units) in mancelona in which we pay approximately $27,000 a year in taxes, that’s a huge chunk of the rental income, we kept to our word in keeping our rent at a normal base ($850-$1100),and yes they are 2 bedroom and 3 bedroom, so no, we aren’t making a dime at this point, but we did it anyway, why should these other developers get that massive of a tax break when we got $0, If that’s the case, we would like the same tax break. I’m sure Jason Green and anchor management would love a massive tax break also, what’s fair is fair